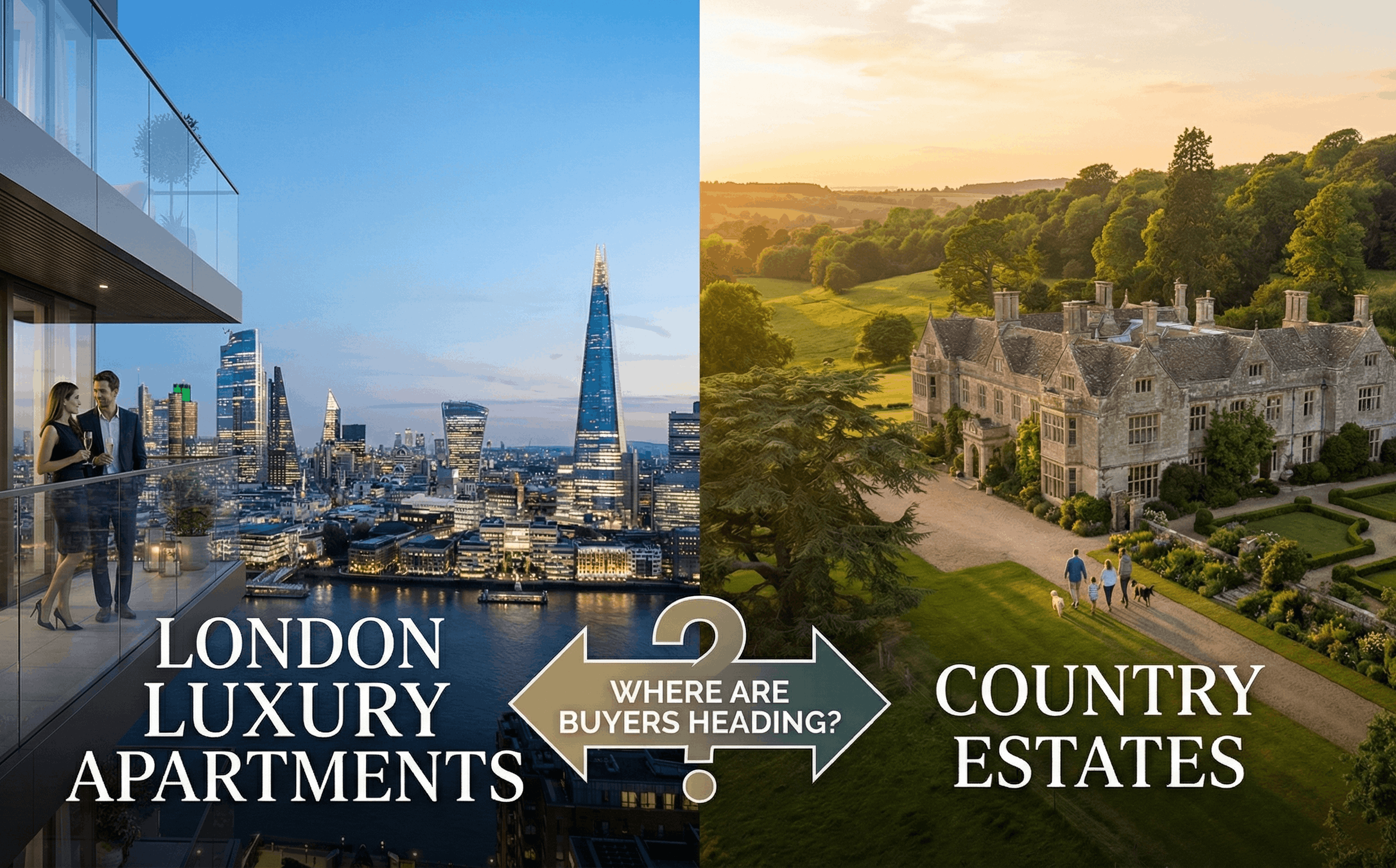

The UK property market is experiencing one of its most fascinating shifts in years. High-net-worth buyers traditionally loyal to prime London real estate are now weighing their options between luxury apartments in London and expansive country estates. As a long-standing voice in the premium property sector, Glentree has observed growing demand in both segments, each driven by lifestyle priorities, investment confidence and evolving buyer sentiment.

In this article, we explore what’s motivating buyers today, where they’re choosing to invest, and how these trends are shaping the future of the luxury housing market.

Why London Luxury Apartments Still Hold Their Appeal

For decades, London has been the epicentre of UK luxury living, and it continues to thrive. Demand for London luxury apartments remains resilient for several key reasons:

1. World-Class Amenities

Prestigious developments in areas such as Hampstead, St John’s Wood, Regent’s Park, and Central London are offering hotel-style living with concierge services, private gyms, secure parking, landscaped gardens, and state-of-the-art security. These features appeal strongly to international buyers and downsizers seeking convenience without compromising luxury.

2. Exceptional Investment Strength

Properties in Prime Central London (PCL) have historically demonstrated long-term value stability. Even during market fluctuations, global demand for London’s finest addresses supports property prices and rental yields, making luxury apartments a compelling asset.

3. Connectivity and Culture

London continues to attract affluent individuals who prioritise fast access to financial districts, Michelin-starred restaurants, cultural institutions and elite schools. For many, the city remains irreplaceable.

The Rise of the Country Estate Buyer

While London remains a global magnet, interest in country estates has surged—particularly among families and individuals seeking more space, privacy and nature.

1. Space, Privacy and Lifestyle

Country homes offer generous acreage, landscaped grounds, home offices, leisure facilities and the tranquillity many buyers now value. Locations such as Hertfordshire, Surrey, Oxfordshire and the Home Counties have seen growing interest among those wanting proximity to London without the intensity of city life.

2. Better Value for Space

Compared to the price per square foot in Prime Central London, country estates provide exceptional value for buyers who want larger living areas, multi-generational spaces, or potential for redevelopment and extensions.

3. A Shift in Work-Life Priorities

Hybrid working continues to influence property choices. Buyers no longer feel bound to live minutes from their office, and many are embracing the opportunity to enjoy vast outdoor spaces without compromising access to London’s amenities.

Who Is Choosing What?

Based on ongoing market activity and Glentree’s experience:

Buyers choosing London luxury apartments typically include:

- International investors

- Downsizers seeking low-maintenance living

- Young professionals want proximity to the city

- Buyers seeking secure, lock-up-and-leave residences

Buyers choosing country estates often include:

- Families needing more space

- Professionals embracing flexible work arrangements

- Buyers prioritising privacy and outdoor living

- Investors considering long-term estate ownership

Is There a Clear Winner?

The truth is : both markets are thriving —but for different reasons.

The choice between luxury apartments in London and country estates near London ultimately depends on lifestyle, investment goals and long-term priorities. Many savvy buyers are even choosing both: a central London apartment paired with a spacious country retreat.

This dual-property trend is growing among high-net-worth individuals who want the best of both worlds—urban convenience and rural serenity.

Final Thoughts

As one of the most trusted names in the UK premium property sector, Glentree continues to guide buyers through a market rich with opportunity. Whether it’s an elegant luxury apartment in London or a distinguished country estate, both choices offer unique advantages, and the current market climate is favourable for well-informed buyers.

If you are considering your next move, Glentree’s specialist team can help you navigate the market with confidence and discretion.